Do I need insurance?

The Answer:

If someone will suffer financially from you dying or not being able to work.

Under-insurance

- 83% of Australian’s have insurance for their car

- Only 31% insure their greatest asset… their ability to earn an income

- Most Australian’s think it won’t happen to them… “She’ll be right mate, won’t she?”

“She’ll be right – Nothing will happen to me”

A typical day in Australia:

- 220 people will be diagnosed with cancer

- There are 132 major coronary events, of which half are fatal

- 47 people will undergo coronary artery bypass-surgery

- 53 people will undergo coronary artery angioplasty procedures

- 34 people under the age of 65 will have their first stroke

What a difference a day makes!

Source: Australian Institute of Health & Welfare

The Problem is……

If you don’t have adequate insurance how will you be able to pay for:

- Medical expenses

- Food, utilities, living expenses

- Schooling

- Funeral expenses

- Credit cards, personal loan debts

- Mortgage

You can’t plan how to invest your income before you haven’t created certainty and protected your income.

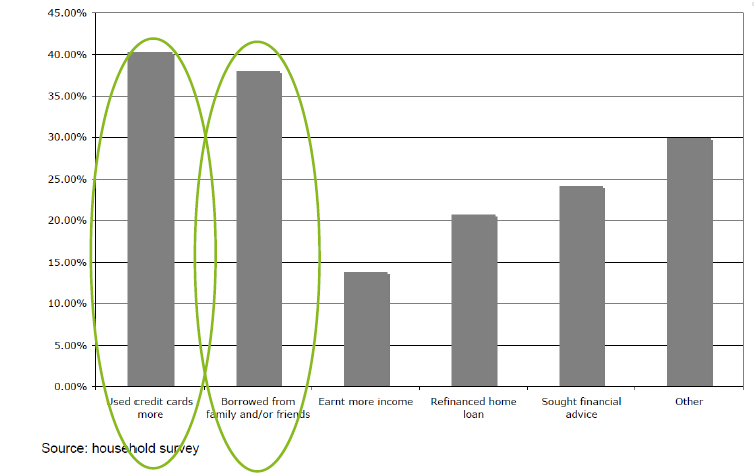

Mortgage… what do people do when they’re going to miss a payment?

We don’t think about personal insurance

Recent survey of young families with household income/assets (excluding the family home) of over $50,000 found that only:

- 48% had life insurance

- 22% had critical illness (trauma)

- 19% had income protection

BUT

- 78% had car insurance

- 80% had home & contents insurance

The Problem is……

- 31% of Australians aged between 18-59 do not have life insurance

- 80% believe they are adequately covered, but usually have only 29% of what they actually require!

- Why do so few people have life insurance?

Why?

- I’m covered by the life insurance in my super fund

- It’s waste of money

- I don’t think I need it

- I don’t like to think about death or serious injury…

Under Insurance

- A recent Rice Warner study estimated the underinsurance gap in Australia is a staggering $1,811 billion.

- 5.4 million families at risk of financial hardship if either parent dies.

- $680,000 is the amount of life insurance needed for a typical middle-income Australian family with two children… $258,000 is the current median level of life insurance.

- 4,400 parents with dependent children die each year.